Many of us may think about spending our golden years in a lovely retirement home where we don’t have to think about any sort of financial problems. Unfortunately, the reality for most senior citizens is that they frequently struggle with financial challenges. From coping with regular debt payments to recovering from financial scams, staying informed is an absolute necessity to ensure that you and your loved ones are able to live a happy, healthy life well into your older years.

Money Shortages

While it’s not uncommon for many people to invest in a retirement plan to help ensure that they have money when they’re no longer able to work a day-to-day job, sometimes these plans don’t always work out as intended. From rising inflation to dealing with unexpected medical issues, money shortages tend to be a growing problem in the senior community.

Unfortunately, many seniors will cut back on essentials like their meals or dosages of medication to help save money when they’re dealing with a period of money shortage. Trying to recover from a shortage can be extremely challenging. Many seniors will simply fall into a snowball of debt problems as time goes on.

Invite your loved one to a conversation over a meal to discuss finances and other critical issues. Also, you can share information on federal or local assistance programs that can help you or your loved ones to better afford some of your day-to-day needs. You can access resources at www.nyc.gov

Rising Healthcare Costs

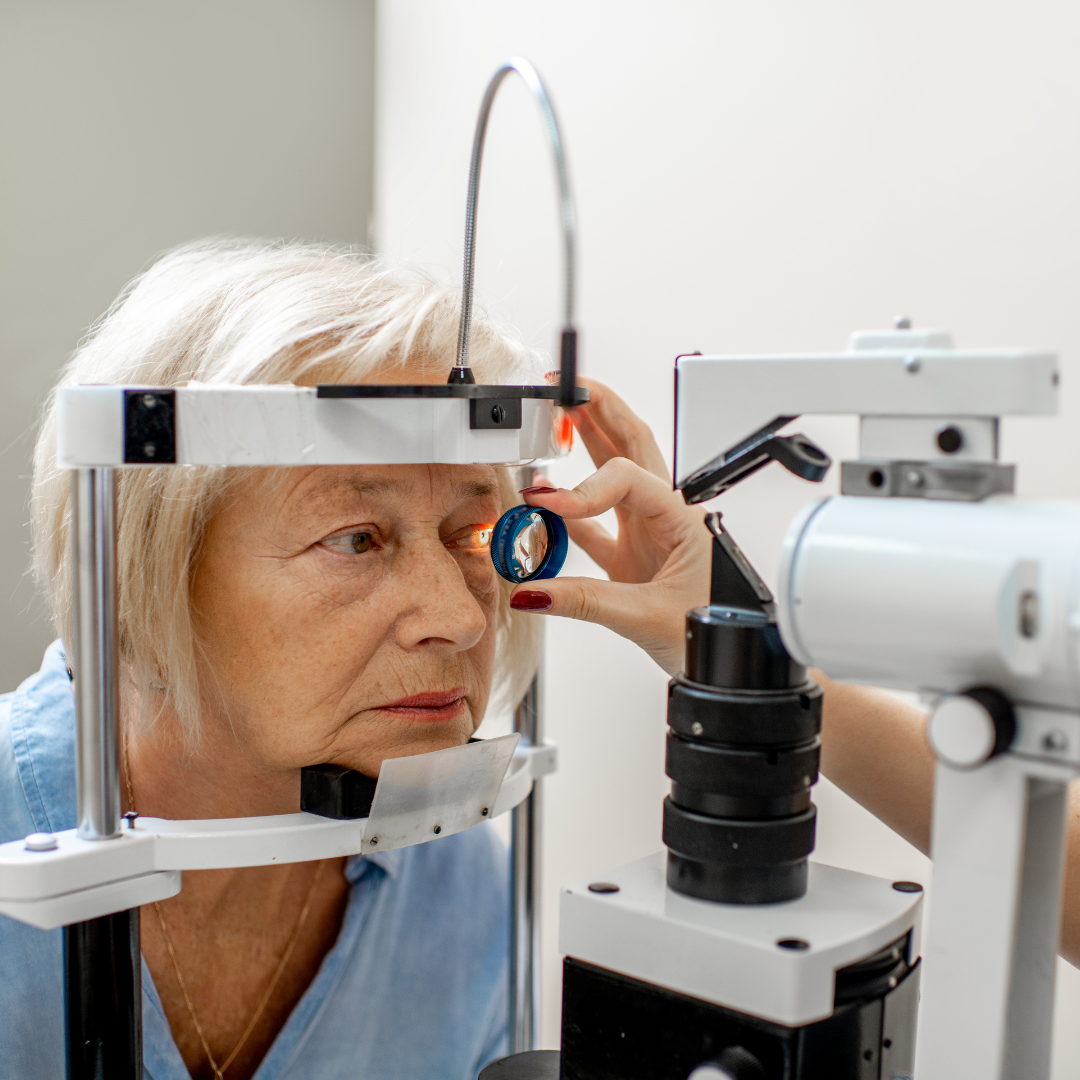

Seniors may now live longer because of medical advances, which is beneficial. However, maintaining chronic health concerns can be costly, and if elders are sick or hurt, they may also face unexpected medical costs. Help your loved one create a health care plan so that some of these expenses can be avoided. For instance, if your loved one could get aid at home, there might not be a need for them to stay in the hospital with a fall-related injury.

Repaying Debts on a Fixed Income

Another area where seniors can run into a lot of issues with their finances is trying to repay back old debts when they shift to a fixed income. It’s easy not to think about how extending your home loan for another 10 years will have an effect on you in the future. However, when you or your loved ones don’t plan to have a fixed income when retire, you’re going to find yourself struggling to repay many of the debts that you took out in your younger years. One of the best ways to help handle debts is to restructure them for a debt consolidation company to make them more manageable to deal with.

Fraud Issues

While it’s not a pleasant thought, many people who are trying to defraud others will seek out the elderly as they’re more susceptible to fraudulent activities. It only takes one telephone scam or mail fraud to lose all the money in your bank account. Trying to recover from that may require borrowing more money that you end up having to pay back and create even more dire financial circumstances moving into the future. Staying up to date on common fraud issues is a great way to help prevent yourself from becoming one of the victims of these schemes.

By far, one of the best ways to avoid many of these financial issues is to be better informed about how they start. Our agency always cares about seniors and keeping them informed. Stay tuned to our updates on Blog.

At All Heart Homecare Agency we are committed to keeping seniors secure in their homes. Our caregivers are reliable, compassionate and professional who are dedicated to address all of your or your loved ones needs. If you are looking for a reliable home care agency in NYC including Brooklyn, Manhattan, Queens, Staten Island and The Bronx, call us today at 888-388-8989 to learn more about our services.